What is Health Insurance, Really? Your Essential Guide to Protecting Your Life and Family

Introduction

Life is a beautiful journey, often filled with moments we cherish: a family dinner, a promotion at work, or a weekend trip to the beach. We plan for these moments. We save for our dream home, our children's education, and our retirement. But amidst all this planning, there is one universal truth we often hesitate to face: life is unpredictable.

A sudden illness, an unexpected accident, or a diagnosis that requires long-term care can happen to anyone, at any time. When these moments strike, the emotional toll is heavy enough without the added weight of financial stress.

This is where health insurance steps in.

At Pansuk Insurance, we don’t see insurance as just a contract or a stack of papers. We see it as a promise—a warm, invisible hug that says, "Don't worry, we've got this." It is about protecting with heart and caring like family. Whether you are a first-time buyer, a working adult looking to secure your future, or a parent protecting your loved ones, understanding health insurance is the first step toward true peace of mind.

In this comprehensive guide, we will strip away the complicated jargon and explain clearly what health insurance is, how it works in the real world (specifically in Thailand), and why it is one of the most loving investments you can make for yourself and your family.

What is Health Insurance? The Caring Safety Net

At its most fundamental level, health insurance is a mechanism for risk management. But let’s look at it through a more human lens. Think of health insurance as a community safety net.

When you purchase health insurance, you enter into a legal agreement with an insurance company. You agree to pay a regular fee, known as a premium. In return, the insurance company agrees to pay for all or part of your medical expenses if you get sick or injured.

How the "Pool" Protects You

Imagine thousands of people all contributing a small amount of money into a central "pool" every month. Most of these people will be healthy and won't need to use the money right away. However, when one person in the group faces a medical emergency—perhaps a surgery that costs 300,000 THB—the money from that pool is used to pay their hospital bills.

Without this pool, that individual would have to find 300,000 THB on their own, likely draining their life savings or forcing them into debt. Health insurance ensures that no single person has to bear the crushing weight of medical costs alone. It transfers the financial risk from you to the insurer.

Why Is It Essential in Thailand?

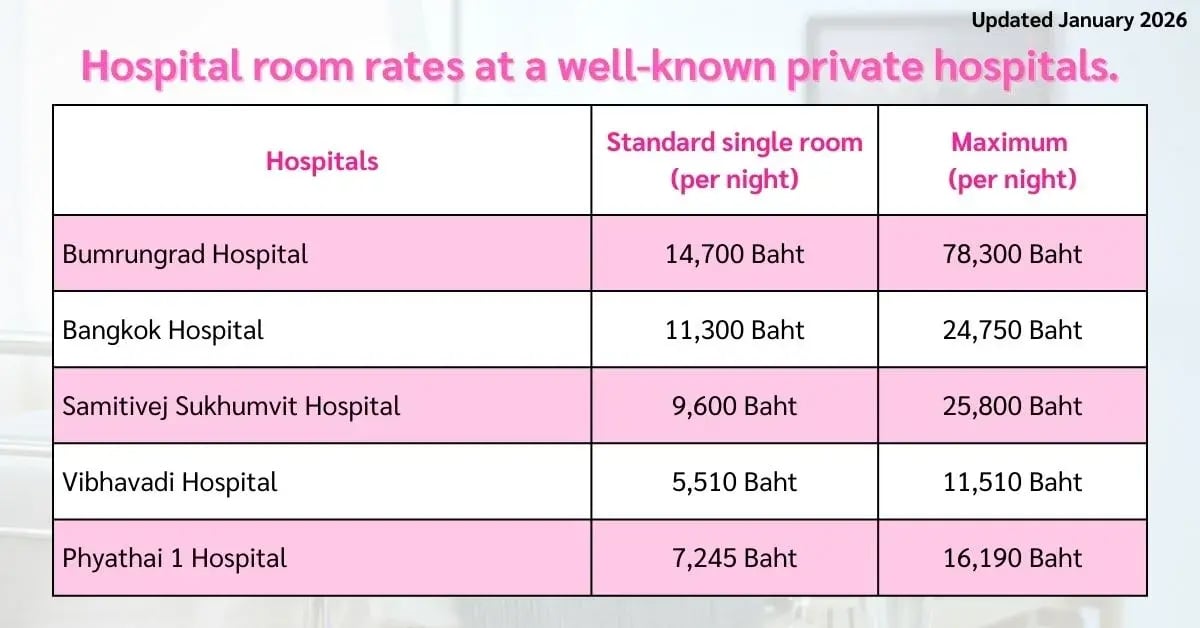

Thailand is renowned for its world-class medical care. Our private hospitals offer five-star service, cutting-edge technology, and immediate access to specialists. However, this quality comes with a price tag.

-

Medical Inflation: The cost of healthcare in Thailand rises every year, often faster than general inflation.

-

Access to Speed: Public hospitals are excellent but often overcrowded. Health insurance gives you the option to choose private care, reducing waiting times significantly.

By having health insurance, you are essentially securing your VIP pass to quality healthcare without putting your financial future in jeopardy.

What is a Health Insurance Policy? Decoding the Blueprint

One of the reasons people avoid insurance is the paperwork. It can feel overwhelming. But a Health Insurance Policy is simply the "User Manual" for your protection. Understanding it empowers you to get the most out of your plan.

A policy is a contract that outlines the terms and conditions of your coverage. Here are the key components you need to know:

1. The Insured and The Beneficiary

-

The Insured: This is the person whose health is protected (e.g., you, your spouse, or your child).

-

The Beneficiary: This is the person or entity who receives the payment. In most health insurance cases, the "beneficiary" is the hospital (via direct billing) or you (via reimbursement).

2. Coverage Limits (The Umbrella Size)

Every policy has a limit. This is the maximum amount the insurer will pay.

-

Lump Sum Limit: A total amount per year (e.g., 5 Million Baht) that covers everything. This is generally preferred as it offers flexibility.

- Itemized Limit: Specific caps for specific services (e.g., 2,000 Baht per day for a hospital room).

Pansuk Advice: Always check if the room rate limit matches the current prices of your preferred hospital.

3. Waiting Periods

You cannot buy fire insurance after your house has started burning. Similarly, you generally cannot use health insurance immediately after buying it.

-

Standard Waiting Period: Usually 30 days for general illnesses (like flu or dengue).

-

Specific Waiting Period: Often 120 days for slow-growing diseases like tumors, stones, or cysts.

-

Pre-existing Conditions: Conditions you had before buying the policy are typically not covered or may require a higher premium. This is why buying insurance while you are young and healthy is the smartest move.

4. Exclusions (What is NOT Covered)

Honesty and transparency are core values at Pansuk Insurance. We want you to know that not everything is covered. Common exclusions include:

-

Cosmetic surgery (unless caused by an accident).

-

Treatments for fertility or pregnancy (unless you buy a specific maternity add-on).

-

Self-inflicted injuries.

The Real-Life Benefits of Health Insurance

Why should you allocate a portion of your monthly income to something you hope you never use? Because health insurance is not an expense; it is an investment in stability. Here are the major benefits:

1. Protecting Your Hard-Earned Savings

Imagine you have saved 500,000 THB for a down payment on a house. A sudden diagnosis of appendicitis requiring emergency surgery and a 3-night hospital stay in a top Bangkok hospital could easily cost 150,000 - 200,000 THB. Without insurance, nearly half of your dream home fund is gone overnight. Health insurance acts as a shield, keeping your savings safe for their intended purpose.

2. Access to Better Medical Care

With health insurance, you have the freedom of choice. You are not restricted to hospitals where you are registered for social security. You can choose the hospital that is closest to you, has the best specialists, or offers the most comfortable facilities. This leads to faster diagnosis and recovery.

3. Tax Deductions in Thailand

The Thai government encourages people to have health insurance. You can deduct the premiums you pay for your own health insurance from your taxable income, up to 25,000 THB per year. If you buy health insurance for your parents, you can deduct up to 15,000 THB (conditions apply). This means you save money on taxes while protecting your health—a double win.

4. Preventive Care and Wellness

Modern health insurance isn't just about fixing you when you break. Many plans now include annual health check-ups, vaccinations, and even dental care. This proactive approach helps you catch potential issues early, which aligns perfectly with our philosophy of caring for you like family.

5. Peace of Mind for Your Loved Ones

If you are the head of the family, your health is the family's greatest asset. Knowing that you are covered relieves the anxiety of your spouse and children. They know that if something happens to you, they won't be burdened with debt.

Understanding the Costs: Premiums, Deductibles, and Co-Payments

When shopping for insurance, you will see various price points. To make a smart decision, you need to understand the cost structure. It’s not just about the monthly fee; it’s about how the costs are shared.

What is the Average Cost of Health Insurance Coverage in Thailand?

There is no single number, but we can give you a realistic range based on the market.

-

Entry Level (IPD Only): For a healthy 30-year-old, a plan covering only hospitalization (In-Patient) might cost between 10,000 - 20,000 THB per year.

-

Mid-Range (Comprehensive): A plan with higher limits (e.g., 5 Million Baht) and some Out-Patient (OPD) coverage often ranges from 25,000 - 45,000 THB per year.

-

Premium Level: Full coverage, high limits, and VIP services can exceed 60,000+ THB per year.

Note: Premiums increase with age. Buying early locks in your insurability.

What is Health Insurance Co-Payment?

This is a term that confuses many, but it is actually a tool to make insurance cheaper. Co-payment (Co-pay) means you agree to share a specific portion of the medical bill.

-

Example: You buy a plan with a 10% Co-pay.

-

Scenario: You have a surgery bill of 100,000 THB.

-

Result: You pay 10,000 THB (10%), and the insurer pays 90,000 THB (90%).

Why choose Co-pay? Plans with co-payments usually have significantly lower premiums. If you are generally healthy and have some emergency cash savings, choosing a co-pay plan is a smart financial move.

Deductibles vs. Co-Payment

While Co-pay is often a percentage or per-visit fee, a Deductible is a fixed amount you must pay first before the insurance starts paying.

-

Example: A plan with a 30,000 THB deductible.

-

Scenario: Your bill is 100,000 THB.

-

Result: You pay the first 30,000 THB. The insurer pays the remaining 70,000 THB. Like co-payment, a deductible drastically reduces your annual premium cost.

Top 3 Health Insurance Considerations in Thailand

With so many companies and plans available, how do you choose? At Pansuk Insurance, we believe in being a trustworthy advisor. We advise you to look at these "Top 3" factors before signing any contract.

1. The Hospital Network and Direct Billing

You do not want to be stuck doing paperwork when you are sick.

-

Look for: A "Direct Billing" or "Fax Claim" service. This means the hospital sends the bill directly to the insurance company. You don't have to pay in advance and wait to be reimbursed.

-

Check: Does the insurer’s network include the hospitals near your home and workplace?

2. The Clarity of Conditions and Renewability

Some policies look cheap but are full of traps.

-

Guaranteed Renewal: Look for policies that guarantee they will renew your contract even if you develop a chronic disease later (as long as you pay the premium).

-

Clear Terms: As a brand that values clear explanations and no complicated jargon, we urge you to read the fine print. Does the policy cover "Targeted Therapy" for cancer? Does it cover "Day Surgery" (surgeries that don't require an overnight stay)?

3. Service and Claims Reputation

The true test of insurance is when you make a claim.

-

Speed: How fast do they approve a claim?

-

Support: Is there a 24-hour hotline? Is the call center staff helpful and empathetic? At Pansuk Insurance, our core strength is being empathetic & supportive. We act as your advocate, ensuring your claims are processed smoothly so you can focus on healing.

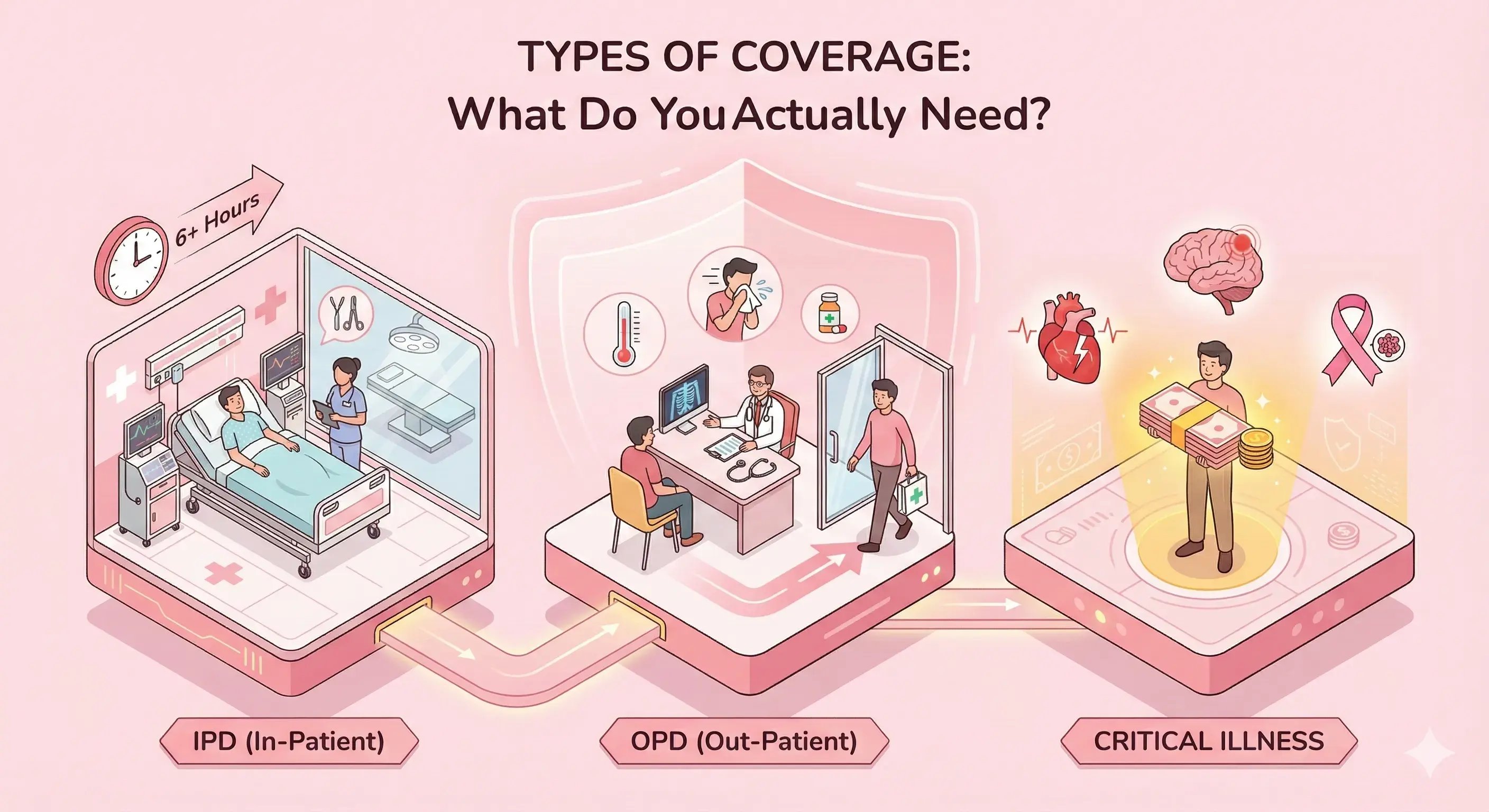

Types of Coverage: What Do You Actually Need?

"Health Insurance" is a broad term. To customize your protection, you should know the different types available in the Thai market.

IPD (In-Patient Department)

This is the "must-have" core. It covers you when you are admitted to the hospital for at least 6 hours. It pays for the room, food, nursing, surgery, and doctor visits during your stay.

OPD (Out-Patient Department)

This covers minor illnesses where you see a doctor and go home the same day (e.g., flu, food poisoning, skin rashes). This is often an optional add-on. If your company provides group insurance with OPD, you might not need to buy extra OPD on your personal plan.

Critical Illness Insurance

This is a special type of insurance that pays a large lump sum of cash if you are diagnosed with a serious disease like cancer, stroke, or heart attack. This cash can be used for anything—medical bills, hiring a nurse, or paying off debt while you cannot work.

Conclusion: Your Partner in Life's Journey

We hope this guide has demystified the world of health insurance for you. It is not just a financial product; it is a fundamental pillar of a secure, happy life. It allows you to live boldly, knowing that if you stumble, there is a soft, strong safety net to catch you.

At Pansuk Insurance, we are dedicated to providing insurance that understands your life. We are here to listen, to advise, and to care for you like family. We combine professional expertise with a warm, human touch to ensure you get the protection that fits your needs and your budget.

Don't leave your future to chance.

If you have questions about which plan is right for you, or if you want to explore the average cost of health insurance coverage tailored to your specific age and lifestyle, we are here to help.

Frequently Asked Questions (FAQ) about Health Insurance

Q1: Do I really need private health insurance if I already have Social Security?

A: This is a very common question. While Social Security provides a good basic safety net, private health insurance fills the gaps in speed and comfort. Social Security often involves long waiting times and limited choices of medication. Private health insurance grants you immediate access to specialists, better drugs, and private rooms, ensuring you recover in comfort without the stress of queuing. Think of Social Security as a standard bus, and private insurance as your personal car—both get you there, but the experience is very different.

Q2: Can I buy health insurance if I already have a medical condition (Pre-existing Condition)?

A: You can still apply, but transparency is key. You must declare your medical history to the insurer. Depending on the severity, the insurer might accept you but exclude coverage for that specific condition, or they might charge a slightly higher premium. At Pansuk, we believe in honest and transparent advice: never hide your history, as it could cause problems with claims later.

Q3: Is health insurance tax-deductible in Thailand?

A: Yes, it is! The Thai government encourages you to protect your health. You can use the premiums paid for your own health insurance to deduct from your taxable income, up to 25,000 THB per year. Additionally, if you buy health insurance for your parents, you can deduct up to 15,000 THB (subject to Revenue Department conditions). It’s a great way to save money while staying protected.

Q4: Do I have to pay the hospital bill first and claim later?

A: In the past, yes. But today, most leading insurers in our network offer "Fax Claim" or Direct Billing services. As long as you go to a hospital within the insurer’s network and your treatment is covered under the policy, the insurance company pays the hospital directly. You generally only pay for expenses that exceed your limit or for non-medical items.

Q5: What happens if I buy insurance but don't get sick all year? Is it a waste of money?

A: Not at all. First, you have "bought" peace of mind for 365 days, which is invaluable. Second, many modern policies offer a "No Claim Bonus"—a discount on your renewal premium if you haven't made any claims during the year. Some plans even offer free annual health check-ups, so you get value even when you are healthy.

You take care of your health. Let us take care of the bills.

Living a healthy lifestyle is the best medicine, but life is full of surprises. Everyone deserves a partner who has their back when things go wrong. Whether you need IPD coverage for peace of mind, or Critical Illness plans for long-term security, we are here to guide you.

No complicated jargon. Transparent conditions. Deep understanding of real life. 👉 [Click here to chat with the Pansuk Team] (Get a warm, personalized quote today.)

Disclaimer: This article provides general information. Insurance coverage conditions are subject to the specific policy terms. Please study the details of coverage and conditions before making a decision.

Dec 15, 2025 12:02:41 AM

.webp?width=520&height=294&name=Co-payment%20(EN).webp)